Published Papers

"Optimal Macroeconomic Policies in a Heterogeneous World"

with James Bullard,

Aarti Singh.

IMF Economic Review 72, September 2024: 991–1041.

Abstract:

We study a DSGE model with “massive” heterogeneity,

enough to approach Gini coefficients for income, wealth, and consumption

in the U.S. data. The economy features three aggregate shocks as well as

both permanent and temporary idiosyncratic risk. We introduce policymakers

that can mitigate these risks for households, and a welfare theorem outlines how the proposed policies imply an optimal allocation of resources. The proposed policies include achieving the Wicksellian natural real rate of interest, social insurance, and a set of taxes and transfers designed to reduce consumption inequality. We calibrate the model to U.S. data from 1995 to 2023 assuming the optimal set of policies and argue that the model fit is promising. This suggests that, broadly speaking, U.S. macroeconomic policy has in recent decades been close to optimal. Improvements beyond this set of policies requires design of responses to very large shocks, and we suggest some directions in which

such a design may proceed.

"The impact of monetary policy on employment in Poland

through the lens of disaggregated data "

with Marta Kightley.

BIS Papers No 142, November 2023: 251–263.

Abstract:

We study the effects of monetary policy shocks on the labor market across firms

in different sectors. Using the local projections method we find that the response of

employment and hiring growth to monetary policy shocks is stronger for firms in the

manufacturing and construction sectors relative to those in the service sector. Those

sectoral differences are also present within firms of the same size. Moreover, we find

that within a sector, employment and hiring growth in large firms respond more to

contractionary monetary policy shocks compared to small firms; the response to expansionary

monetary policy shocks is less compared to small firms. Finally, we find

that the differences in the employment and hiring growth between small and large firms

are greater for firms in the manufacturing and construction sectors, compared to those

between small and large firms in the service sector.

"Monetary policy, labor market, and sectoral heterogeneity"

with Aarti Singh,

Anastasia Zervou.

AEA Papers & Proceedings 112, May 2022: 491–495.

Abstract:

We study the effects of monetary policy shocks on the labor market across firms

in different sectors. Using the local projections method we find that the response of

employment and hiring growth to monetary policy shocks is stronger for firms in the

manufacturing and construction sectors relative to those in the service sector. Those

sectoral differences are also present within firms of the same size. Moreover, we find

that within a sector, employment and hiring growth in large firms respond more to

contractionary monetary policy shocks compared to small firms; the response to expansionary

monetary policy shocks is less compared to small firms. Finally, we find

that the differences in the employment and hiring growth between small and large firms

are greater for firms in the manufacturing and construction sectors, compared to those

between small and large firms in the service sector.

"Are DSGE Models Irreparably Flawed?"

with Michał Brzoza-Brzezina.

Bank i Kredyt / Bank & Credit 52(3), June 2021: 227–252.

Abstract:

In this paper we respond to the recent critique of Dynamic Stochastic General Equilibrium (DSGE)

models. We present the most recent developments in the DSGE literature and show that it has gone

a long way to accommodate many sources of criticism.

"Optimal Monetary Policy at the Zero Lower Bound"

with Costas Azariadis, James Bullard, Aarti Singh.

Journal of Economic Dynamics and Control 103, June 2019: 83–101.

Abstract:

We study monetary policy when private credit markets are incomplete.

The macroeconomy we study has a large private credit market,

in which participant households use non-state contingent nominal contracts (NSCNC).

A second, small group of households only uses cash, supplied by the monetary authority,

and cannot participate in the credit market. There is an aggregate shock.

We find that, despite the substantial heterogeneity, the monetary authority can provide

for optimal risk-sharing in the private credit market and thus overcome the

NSCNC friction via a counter-cyclical price level rule. The counter-cyclical

price level rule is not unique. To pin down a unique monetary

policy rule, we consider two secondary goals for the monetary authority,

(i) expected inflation targeting and, (ii) nominal GDP targeting.

We examine the impact of each of these approaches on the price level

rule and other nominal variables in the economy.

St. Louis Fed Working Paper 2015-010. Close

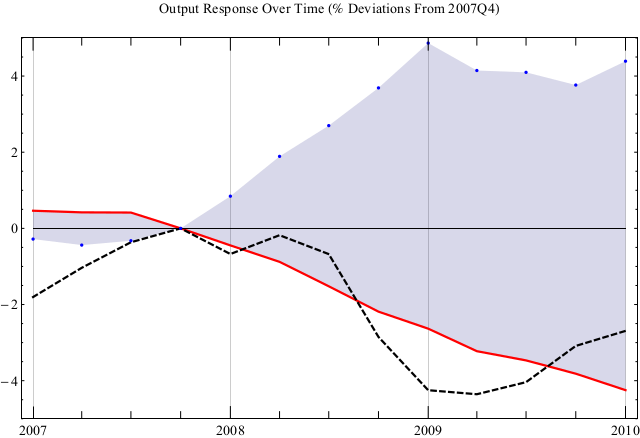

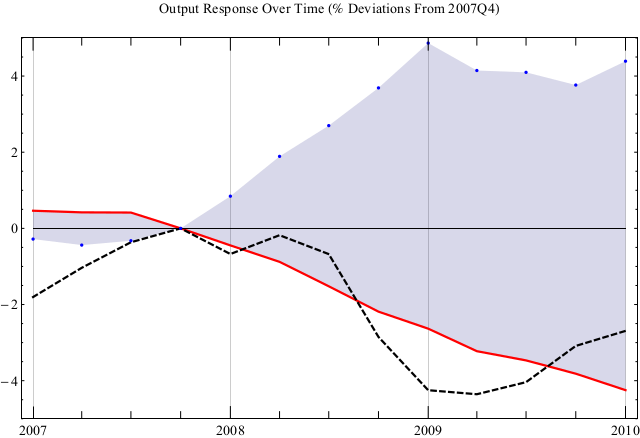

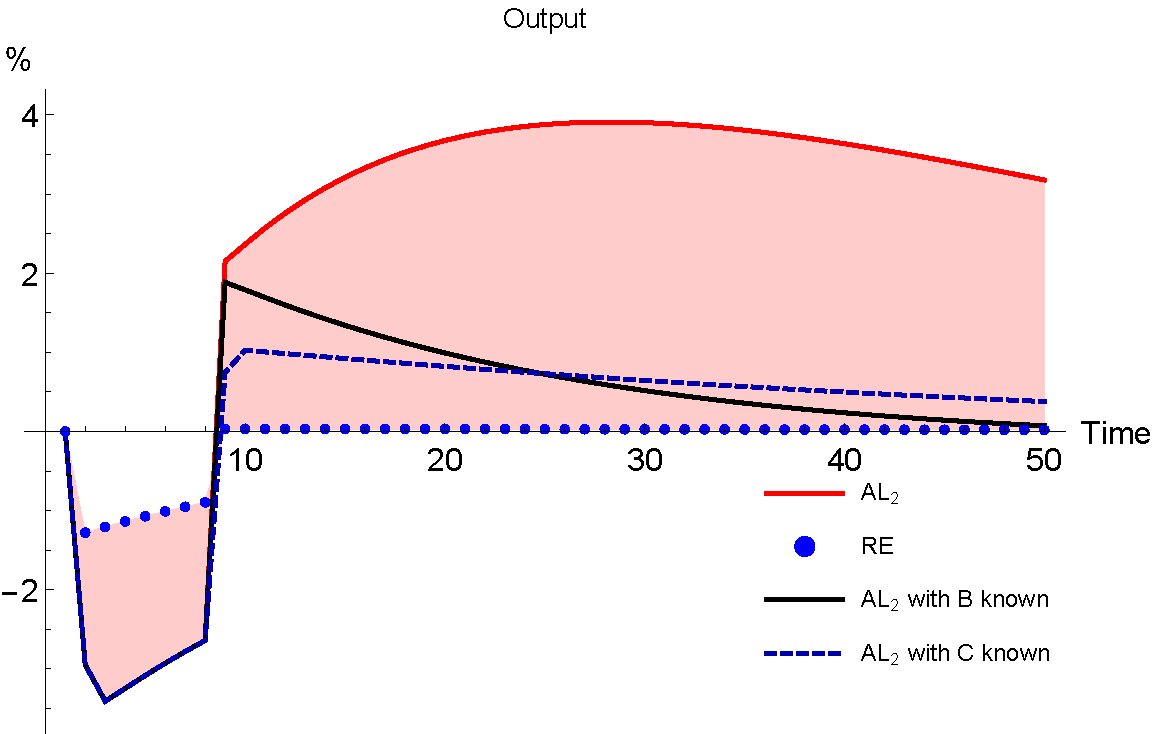

"Learning Leverage Shocks and the Great Recession"

with Patrick Pintus.

Review of Economic Dynamics 31, January 2019: 123–146.

Abstract:

This paper develops a simple business-cycle model in which financial shocks have large

macroeconomic effects when private agents are gradually learning the uncertain environment.

Agents update their beliefs about the reduced-form structure of the economy. Because the

persistence of leverage is overestimated by adaptive learners, the responses of output, investment,

and other aggregates under adaptive learning are significantly larger than under rational

expectations. In our benchmark case calibrated using US data on leverage, debt-to-GDP and

land value-to-GDP ratios for 1996Q1-2008Q4, learning amplifies leverage shocks by a factor

of about three, relative to rational expectations. When fed with actual leverage innovations

observed over that period, the learning model predicts that the persistence of leverage shocks is

increasingly overestimated after 2002 and that a sizeable recession occurs in 2008-10, while its

rational expectations counterpart predicts a counter-factual expansion. In addition, we show

that procyclical leverage reinforces the amplification due to learning and, accordingly, that

macro-prudential policies that enforce countercyclical leverage dampen the effects of leverage

shocks.

GRAPE Working Paper 28 Close

"Belief-Twisting Shocks and the Macroeconomy"

Macroeconomic Dynamics 22(7), October 2018: 1844–1858.

Abstract:

I study the role of shocks to beliefs combined with Bayesian learning in a

standard equilibrium business cycle framework. In particular, I examine how a

prior belief arising from the Great Depression may have influenced the macroeconomy during the last 75 years. In the model, households hold twisted beliefs

concerning the likelihood and persistence of recession and boom states that are

affected by the Great Depression. These initial beliefs are substantially different

from the true data generating process and are only gradually unwound during

subsequent years. Even though the driving stochastic process for technology is

unchanged over the entire period, the nature of macroeconomic performance is

altered considerably for many decades before eventually converging to the

rational expectations equilibrium. This provides some evidence of the lingering

effects of beliefs-twisting events on the behavior of macroeconomic variables.

Keywords: Bayesian learning, business cycles, non-linear dynamics

BdF Working Paper 434 Close

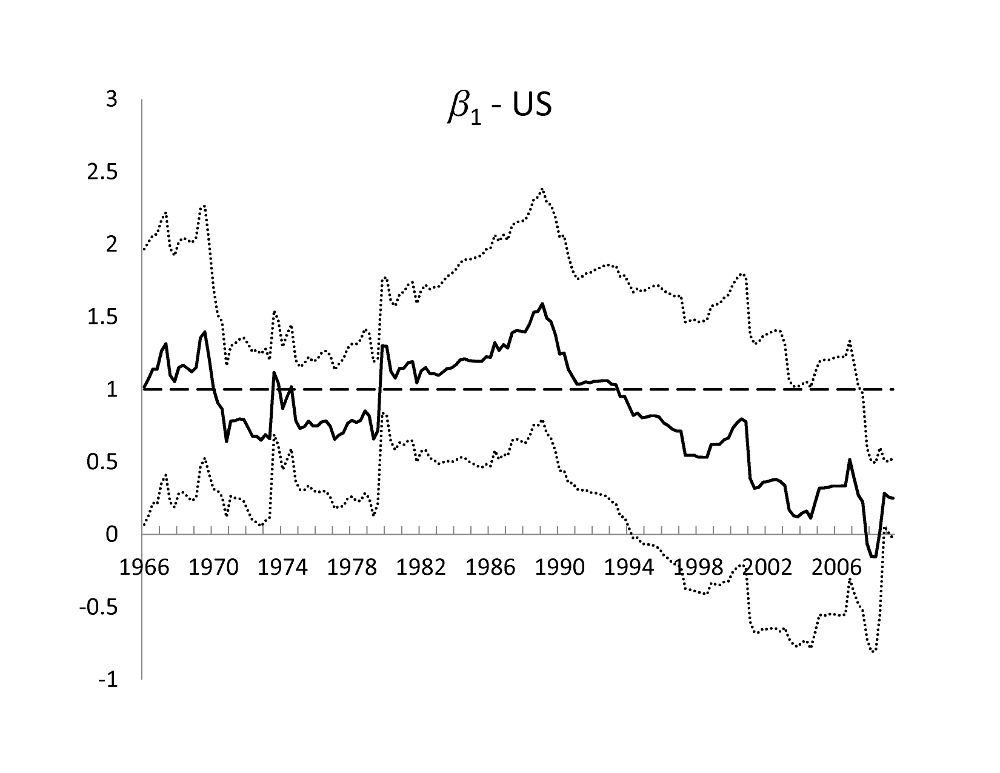

"International Great Inflation and Common Monetary Policy" with Anastasia Zervou.

Macroeconomic Dynamics 22(6), September 2018: 1428–1461.

Abstract:

We study whether monetary authorities in the G7 countries were changing their

responses to inflation in a similar manner during and following the Great Inflation

era. We find that the common to the G7 countries inflation pattern during the Great

Inflation period could be associated with a common pattern in the monetary policy

response to inflation: we find that until the early 1980s monetary authorities in the

G7 countries responded mildly to inflation, systematically fought it throughout the

1980s and lessened again their response during the 2000s. The estimated Taylor rule

coefficients on inflation are cointegrated, implying the existence of a long run relationship

in the responses to inflation during and after the Great Inflation period. At the

same time, principal component analysis of the residuals of the estimated Taylor rules

indicates that the shocks' structure cannot account enough for the monetary policies'

comovements. We interpret these findings as suggestive of common monetary policy

patterns.

"The Stability of Macroeconomic Systems with Bayesian Learners" with James Bullard

Journal of Economic Dynamics and Control 62, January 2016: 1–16.

Abstract:

We study abstract macroeconomic systems in which expectations

play an important role. Consistent with the recent literature on recursive learning and expectations, we replace the agents in the economy with econometricians. Unlike the recursive learning literature,

however, the econometricians in the analysis here are Bayesian learners. We are interested in the extent to which expectational stability

remains the key concept in the Bayesian environment. We isolate

conditions under which versions of expectational stability conditions

govern the stability of these systems just as in the standard case of

recursive learning. We conclude that Bayesian learning schemes, while

they are more sophisticated, do not alter the essential expectational

stability findings in the literature.

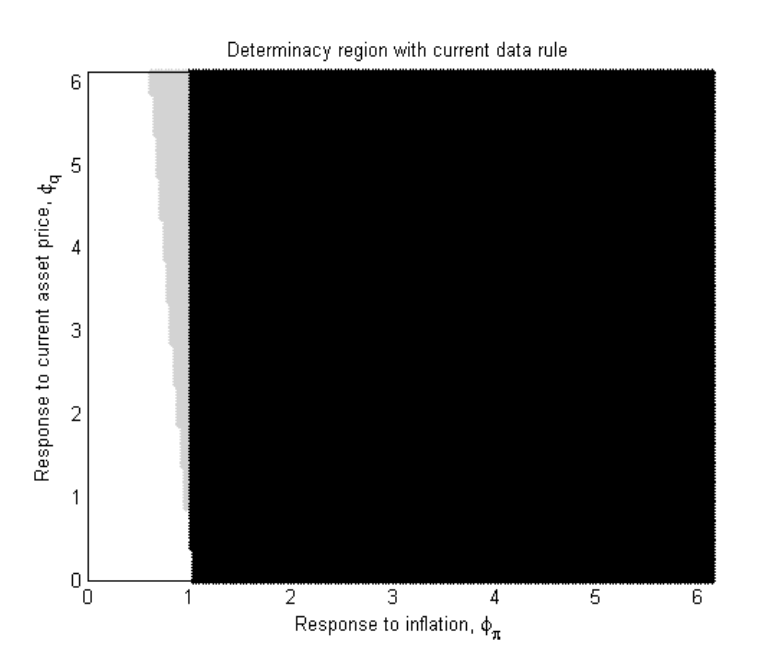

"Monetary Policy and the Financial Sector" with Aarti Singh, Sophie Stone.

Economics Letters 132, July 2015: 82–86.

Abstract:

In this paper we study whether central banks should react to financial

sector variables in their policy rules. We find that responding

to asset prices does not affect the determinacy conditions. However,

responding to entrepreneurial net worth increases the likelihood of

determinacy.

Working Papers

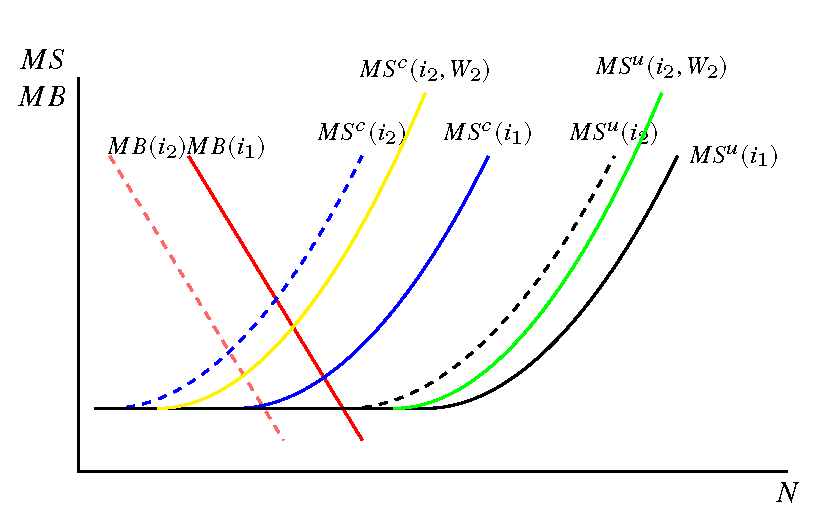

"Labor Market Response to Monetary Policy: Financing Frictions and the Wage Effect"

with Aarti Singh, Anastasia Zervou.

revision requested at the Macroeconomic Dynamics

SSRN link

Abstract:

We extend the theoretical frameworks traditionally used to analyze monetary policy and investment to examine firms' decisions regarding labor input. Specifically, we consider a model with financing constraints and firms that vary in their degree of exposure to these constraints. The model incorporates key features such as a working capital constraint, the financial accelerator effect of monetary policy, and an upward-sloping marginal cost curve—elements typically employed to study the impact of monetary policy on investment. Our analysis introduces the wage effect, an input cost absent in traditional studies on monetary policy and investment. The findings reveal that uniform wage changes can produce heterogeneous employment responses between financially constrained and unconstrained firms, operating through the wage channel.

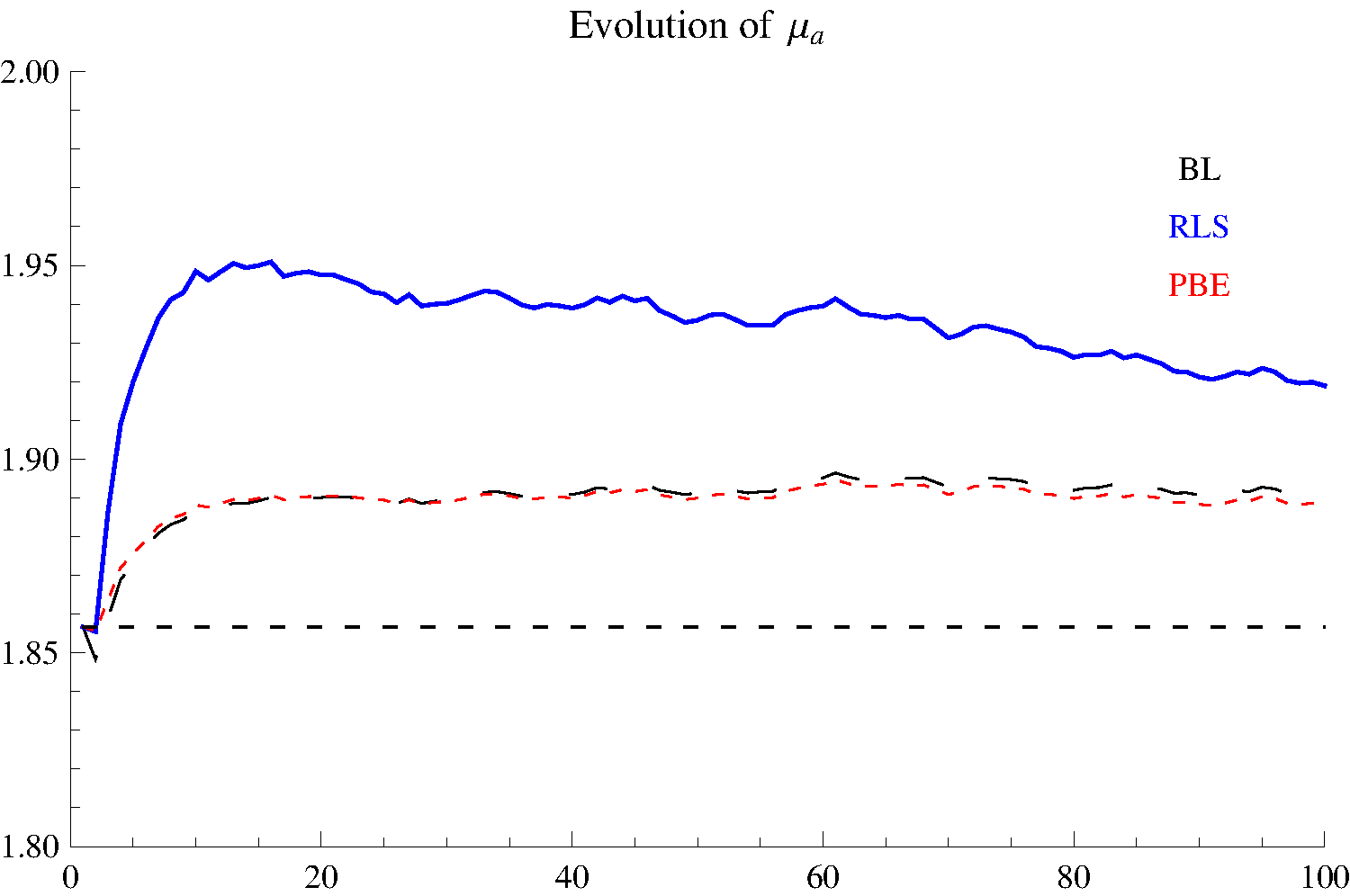

"The Dangers of Macro-prudential Policy Experiments: Initial Beliefs under Adaptive Learning"

with Patrick Pintus, Burak Turgut.

revision requested at the Macroeconomic Dynamics

GRAPE Working Paper 49/2021

Abstract:

The paper studies the implication of initial beliefs and associated confidence on the system's dynamics under adaptive learning in the context of policy considerations. We examine how discretionary experimenting with new macroeconomic policies is affected by expectations that agents have in relation to these policies. We show that a newly introduced macroprudential policy that aims at making leverage counter-cyclical can lead to substantial increase in fluctuations under learning, when the economy is hit by financial shocks, if beliefs reflect imperfect information about the policy experiment. This is in the stark contrast to the effects of such policy under rational expectations.

"Mapping the protection gap: How risk perception and social vulnerability drive flood memory patterns in the U.S."

with Eric Contreras, Nadja Veigel, Heidi Kreibich, Andrea Cominola.

submitted

Abstract:

This study investigates the temporal dynamics of flood insurance adoption patterns across U.S. counties by analyzing National Flood Insurance Program data through the lens of social memory and risk perception. Using change point detection methodologies, we identify significant shifts in insurance purchasing behavior following flood events and quantify both the magnitude (salience) and memory (time-to-forget) of these post-flood responses. We show that social memory of flood events, as measured through insurance participation rates, may be considerably shorter and more heterogeneous than previously suggested in the literature. By including demographic, environmental, and institutional variables, we disentangle the multi-modal distribution of salience and memory. We identify three components driving insurance adoption: social vulnerability, risk perception, and flood damage patterns. Subsequent cluster analysis of these components reveals five distinct county profiles, with particularly notable findings regarding areas where social vulnerability coincides with low risk perception. The results demonstrate spatiotemporal variations in community responses to flood risks and suggest that only diverse approaches can successfully maintain equitable sustained insurance coverage.

"Heterogeneous labour market response to monetary policy: small versus large firms"

with Aarti Singh, Anastasia Zervou.

NBP Working Paper 355/2023,

SSRN link

Abstract:

This paper studies how monetary policy affects employment and hiring growth across firms of different sizes and how these effects vary with the direction of the policy shock. Using high-frequency monetary policy surprises and disaggregated data from the U.S. Quarterly Workforce Indicators (QWI), we estimate impulse responses for small and large firms separately. We find that monetary contractions reduce employment and hiring growth more in large firms, while expansions stimulate that of small firms more. These effects are stronger for hiring flows than for employment levels and unfold asymmetrically over time; contractionary effects are immediate, while expansionary responses are more delayed. As an implication of the increasingly employment concentration in large firms, the aggregate labor market response to monetary policy has shifted: contractionary policy has become more effective at reducing employment and hiring growth, while expansionary policy has become less effective at boosting it. These results highlight the importance of accounting for firm size, the direction of monetary policy shocks, employment flows as well as employment concentration, when evaluating the transmission of monetary policy to the labor market.

"Business Cycles and On the Job Search" with Marek Antosiewicz.

IBS Working Paper 7/2016.

Work in progress

"Estimating financial frictions under learning" with Patrick Pintus , Burak Turgut.